History of the Federal Work-Study program

Published 7:13 pm Tuesday, January 18, 2022

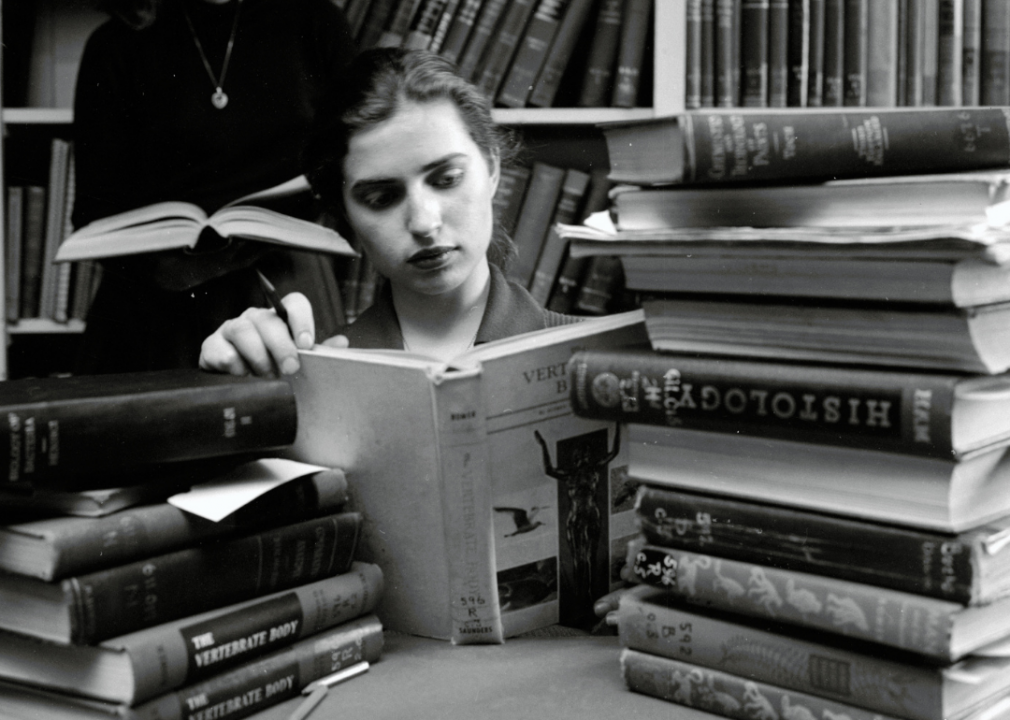

Carsten/Three Lions // Getty Images

History of the Federal Work-Study program

The Federal Work-Study (FWS) program, part of the Economic Opportunity Act of 1964, was created to increase access to higher education for low-income students. But while the program removed certain mid-century barriers, it has widely been seen as not keeping up with the times—particularly as tuition, cost of living, and inflation continue to rise.

To learn more about FWS and see how it has fared amid an ever-changing education system and culture, StudySoup analyzed data collected by the U.S. Department of Education to understand how the federal work-study program has grown since it first began in 1965. Data were included for every five years since FWS was established and up to the most recent year available, 2017–2018. Dollar amounts for each year are not adjusted for inflation. The average tuition cost compared to the average work-study earnings per student is included as an indicator of the relative increase in tuition versus federal work-study dollars.

To qualify for work-study, full- or part-time students at accredited collegiate programs must complete and submit the Free Application for Federal Student Aid (FAFSA) application. FAFSA applications are also required for certain grants and loan assistance programs. All applicants must submit proof of financial need, which requires paperwork illustrating household income and size. Early FAFSA applicants often have a better chance of being considered, as some schools determine aid on a first-come-first-served basis.

FWS jobs run the gamut, from producing media broadcasts for athletic events to answering phones. In the coronavirus era, students who relied heavily on these positions were forced off campus, many with no remote options to continue working. There have also been many talks of the inefficient, at times exploitative, allocation and funding formula when it comes to FWS programs. For example, a study from the Urban Institute suggests a large portion of FWS funding goes toward older, wealthier institutions. That reduces opportunities for community college students who are most likely to be low-income.

Most significantly, the concept of working one’s way through college is nearly impossible when average work-study salaries are compared to average tuition costs.

In 2019, there were 19.6 million college students with an estimated 14.5 million enrolled in public colleges and 5.14 million enrolled in private institutions. The usual eligible amount for work-study per year, per eligible student, is $2,000 to $5,000—figures that barely scratch the surface of average tuition costs. In 2020, President Trump proposed a $630 million cut to the work-study program; the proposal was rejected by the Senate appropriations subcommittee. President Biden has proposed focusing work-study programs on career-related jobs or public services.

Keep reading to learn more about the history of FWS.

![]()

Warren K Leffler/US News & World Report Collection/PhotoQuest // Getty Images

1965–66

– Total dollars earned by work-study participants: $33.4 million ($290 per student)

– Average tuition cost: $884

– Average work-study earnings compared to tuition: 32.8%

– Total participating schools: 1,095

– Total recipients: 115,000

The U.S. government first offered student loans in 1958 under the National Defense Education Act, which was available to a select number of students. The Economic Opportunity Act of 1964 featured a section on a new work-study program designed to remove poverty-related barriers to pursuing higher education by providing part-time jobs to active students to help pay for tuition and fees.

The program was transferred in 1965 from the Department of Labor to the Department of Health, Education, and Welfare in 1965 with the Higher Education Act (HEA). That act pushed for social mobility and democratized educational opportunities by authorizing several federal aid programs for individuals pursuing postsecondary education. Financial assistance programs such as Pell Grants (which don’t need to be paid back ) and Stafford loans (which do need to be paid back) were created as a result of the HEA, and all are often sought in tandem by students applying for aid. Preference for work-study was given to low-income students.

Carsten/Three Lions // Getty Images

1970–71

– Total dollars earned by work-study participants: $200.3 million ($470 per student)

– Average tuition cost: $1,120

– Average work-study earnings compared to tuition: 42%

– Total participating schools: 2,386

– Total recipients: 425,000

The number of Americans attending colleges from 1940 to 1970 ballooned by 13%.

The City University of New York in 1970 implemented an open admissions policy, and in 1971, LaGuardia Community College, part of CUNY, was founded. LaGuardia has gone on to provide part-time FWS for students able to work part-time on- or off-campus to assist with their education costs.

The 1972 revision to the 1965 Higher Education Act included a new section called “Work-Study for Community Service Learning Program.” For this addition, preference was given to students at eligible institutions and veterans who served in the armed forces. Grants were afforded to public and non-profit agencies to pay students employed in jobs that offered community services or had other, educational value.

Universal History Archive/Universal Images Group via Getty Images

1975–76

– Total dollars earned by work-study participants: $295 million ($518 per student)

– Average tuition cost: $1,473

– Average work-study earnings compared to tuition: 35.2%

– Total participating schools: 3,154

– Total recipients: 570,000

The Age Discrimination Act of 1975 was implemented and prohibited age discrimination for any programs or activities receiving federal financial assistance, including work-study. By 1976, Congress had concerns about receiving more funding from banks for postsecondary education. There were amendments put into place for states to have loan guarantee agencies.

FWS covered 90% of tuition costs at four-year public institutions in the mid-’70s; by 2017, the average FWS award (roughly $1,550 each year) accounted for just 16% of tuition and fees.

Tom Grauman/Corbis via Getty Images

1980–81

– Total dollars earned by work-study participants: $660.2 million ($806 per student)

– Average tuition cost: $2,230

– Average work-study earnings compared to tuition: 36.1%

– Total participating schools: 3,135

– Total recipients: 819,093

By 1980, the average cost of college per year, including tuition, fees, and room and board, was $8,756 with the Pell Grant maximum award amount at $1,750.

Dental and business schools exhausted work-study funding during the 1980–81 academic year due to program changes and heightened tuition costs, according to reporting from the Harvard Crimson. From 1980 to 1985, spending on higher education was reduced by 25%, including $594 million in student assistance.

Tom Grauman/Corbis via Getty Images

1985–86

– Total dollars earned by work-study participants: $656 million ($901 per student)

– Average tuition cost: $3,367

– Average work-study earnings compared to tuition: 26.8%

– Total participating schools: 3,305

– Total recipients: 728,398

In 1985, President Ronald Reagan proposed slashing student loans even further than in his first term, limiting the scope of federal assistance to families with incomes below $32,500 regardless of household size. Families with higher incomes than that threshold, the president proposed, ought not to be eligible for grants, work-study programs, or other forms of financial aid. Reagan proposed that families with higher incomes would instead have access to unsubsidized loans up to $4,000.

In a 2014 piece for Salon, journalist Peter Lunenfeld summarized Reagan’s relationship with student aid this way: “Throughout Reagan’s presidency, funding for outright grants-in-aid decreased, federal guidelines pushed individual loans, and private bill collectors were brought in to ensure that the hardest kind of debt to escape was whatever you took on for your education.”

David Butow/Corbis via Getty Images

1990–91

– Total dollars earned by work-study participants: $727.8 million ($1,059 per student)

– Average tuition cost: $3,930

– Average work-study earnings compared to tuition: 26.9%

– Total participating schools: 3,495

– Total recipients: 687,436

The Americans With Disabilities Act of 1990 prohibits disability-based discrimination at all locations available to the public, including private institutions and schools—and including work-study opportunities for students.

Following the passage of the act, colleges and universities were required to provide better accommodations for students with disabilities, from accessible dorm rooms to special assistive technologies.

The Higher Education Amendments of 1992 applied significant changes to work-study, including a mandated 5% funds allocation for students performing community services.

Mel Melcon/Los Angeles Times via Getty Images

1995–96

– Total dollars earned by work-study participants: $763.7 million ($1,087 per student)

– Average tuition cost: $4,725

– Average work-study earnings compared to tuition: 23%

– Total participating schools: 3,249

– Total recipients: 702,365

Throughout the ’90s, work-study income drifted further away from average tuition costs, dropping below one-quarter of tuition costs for the first time.

“How Much Student Loan Debt is Too Much?,” a study by Keith Greiner published in 1996 in the Journal of Student Financial Aid, poses the notion that monthly student debt payment for undergraduate students shouldn’t be more than 8% of total monthly income post-graduation. As federal policies change, maximum borrowing amounts have been adjusted.

Jay Yuan // Shutterstock

2000–01

– Total dollars earned by work-study participants: $939 million ($1,318 per student)

– Average tuition cost: $5,466

– Average work-study earnings compared to tuition: 24.1%

– Total participating schools: 3,221

– Total recipients: 712,599

In 1998, President Bill Clinton signed the Higher Education Act of 1965 reauthorization which upped the community-service mandate in the FWS to 7%. This went into effect by 2000. Another noteworthy change was that work-study students could now receive payment for training or time spent commuting to their community service positions. The increase in funding and wider percentage allocated for community service work was due to a big jump in funding allocated for the program.

SeventyFour // Shutterstock

2005–06

– Total dollars earned by work-study participants: $1.1 billion ($1,478 per student)

– Average tuition cost: $7,236

– Average work-study earnings compared to tuition: 20.4%

– Total participating schools: 3,420

– Total recipients: 710,907

August 2005 was met with one of the worst natural disasters in history as Hurricane Katrina slammed into the Gulf Coast. The storm affected an estimated 100,000 students in the area as campuses and businesses closed, creating a paradox for work-study students who had to finish courses and pay tuition without the benefit of work hours or paychecks.

The same year also saw the Higher Education Reconciliation Act of 2005. The bill increased loan fees from 7.9% to 8.5% and allowed graduate students to take out PLUS loans.

Leigh Trail // Shutterstock

2010–11

– Total dollars earned by work-study participants: $1.2 billion ($1,668 per student)

– Average tuition cost: $8,868

– Average work-study earnings compared to tuition: 18.8%

– Total participating schools: 3,291

– Total recipients: 718,427

The year 2010 saw a major legislative win for President Barack Obama, who called for an overhaul of student loan programs and brought an end to the Federal Family Education Loan Program (FFEL).

FFEL supported private loans for students, subsidized by the federal government. The program had been in place since 1965 and allowed commercial lenders like banks to finance loans under FFEL with subsidies used toward interest rates. The FFEL program was replaced with direct federal lending to students, eliminating the private lenders who were protected by taxpayers from the risk of default.

Just 16.4% percent of dependent students with households bringing in fewer than $20,000 annually received FWS aid during the 2011-2012 school year; 8.2% percent of dependent students with families earning more than $100,000 received FWS aid.

TIMOTHY A. CLARY/AFP via Getty Images

2015–16

– Total dollars earned by work-study participants: $1.1 billion ($1,726 per student)

– Average tuition cost: $10,407

– Average work-study earnings compared to tuition: 16.6%

– Total participating schools: 3,201

– Total recipients: 634,931

For the 2015-16 academic year, 72% of undergraduate students were recipients of some form of financial aid whether through loans, grants, or work-study. During this time, more discussions were held regarding the allocation of funds. In 2015, community colleges only received 15% of federal work-study funding, compared to four-year colleges and universities that received much more.

GaudiLab // Shutterstock

2017–18

– Total dollars earned by work-study participants: $1 billion ($1,647 per student)

– Average tuition cost: $12,613

– Average work-study earnings compared to tuition: 13.1%

– Total participating schools: 3,179

– Total recipients: 612,626

The year 2017 saw a significant increase in student debt at four-year institutions, which totaled $1.34 trillion. There were also changes to the submission date for FAFSA, which work-study grants fall under. The application release date was October 2016 instead of January 2017. Applicants were also required to report income information a year earlier. These new changes allowed families more time to prepare the necessary documents.

Of the more than 3,000 institutions allocated FWS funding, about half offered funding to more than 100 students for the school year.

This story originally appeared on StudySoup

and was produced and distributed in partnership with Stacker Studio.