Inflation of goods vs. gold: How these costs have changed over time

Published 3:00 pm Friday, March 1, 2024

Inflation of goods vs. gold: How these costs have changed over time

Gold has historically played an essential role as a store of value in economies worldwide.

The U.S. dollar used to be backed by gold, meaning money was exchangeable for an amount of the metal. This is known as the gold standard, which the U.S. started to abandon in 1933 during the Great Depression. With the rise of modern monetary policy, other countries followed suit and switched to the fiat currency used now, which is money backed by a government, not a physical asset.

Nowadays, gold is valued as a commodity to invest in, and many people see it as a hedge against high inflation and a safe-haven asset during times of recession or political tensions. Historically, the price tends to increase when inflation becomes high.

Since there is a limited global supply of gold, the metal, known for its luster and corrosion resistance, has earned a reputation as an asset with enduring value. Investors often seek out gold and other tangible commodities to offset the dollar’s weaker buying power when prices of goods and services rise.

While gold has indeed kept its value over time, its link with inflation hasn’t always held up, particularly in recent decades. Gold prices change for many reasons and can be volatile in the short term. Still, many people look to gold as one way to diversify long-term investments.

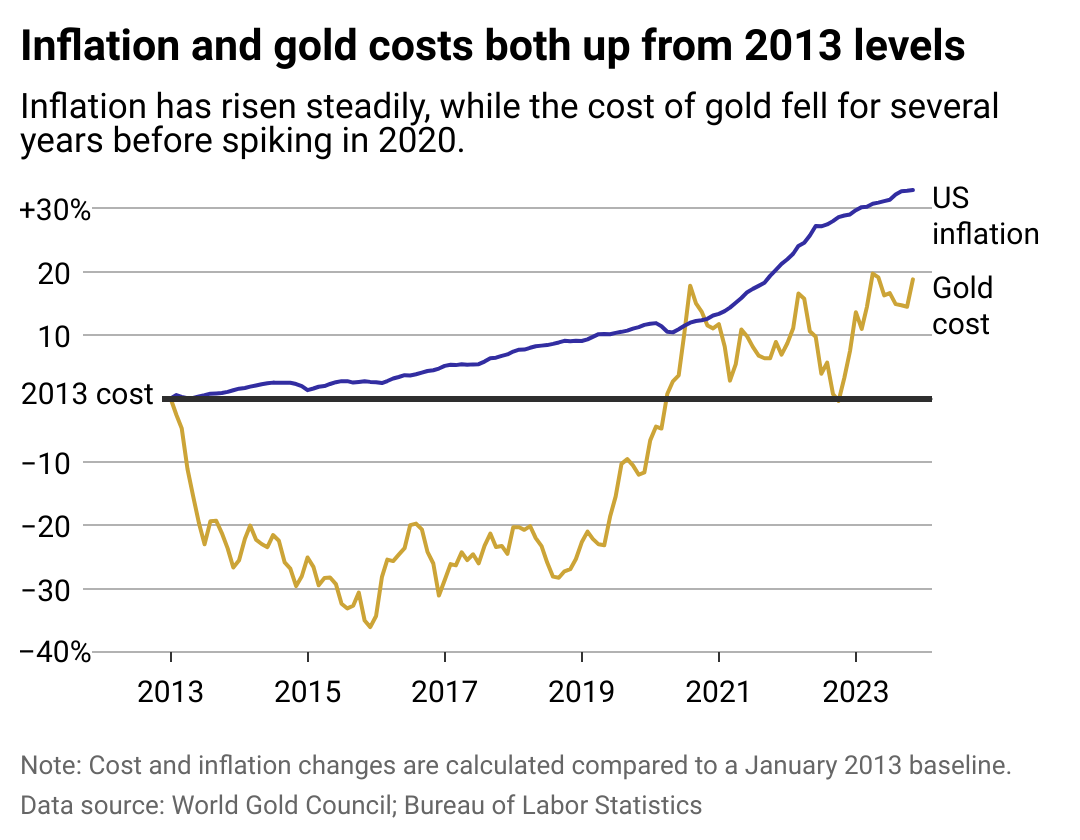

SD Bullion charted the changes in gold prices compared to U.S. inflation over the last decade, using data from the World Gold Council and the Bureau of Labor Statistics.

![]()

SD Bullion

A decade of gold prices

When fiat currencies lose value quickly during inflation, gold has historically become more appealing to investors. However, parts of the past decade followed a somewhat unusual pattern. While inflation increased over those 10 years, the price of gold was in decline in the mid-2010s.

A significant reason behind that drop in gold prices—in contrast with rising inflation—was the 2013 gold crash, when the metal’s price fell 15% in two trading days. Weak sales of gold during the Lunar New Year, rumors of the Central Bank of Cyprus selling gold as part of a bailout, and noticeably high volumes of computerized trading were among the factors that influenced the slump before prices started upward again.

During the COVID-19 pandemic, the high-risk atmosphere and low interest rates incentivized investors to switch to gold to safeguard their wealth. The rising demand for gold—partially in reaction to talk of government stimulus, inflation, and economic downturn—made the metal outperform other assets in 2020, the World Gold Council noted. That August, the price of gold hit $2,067.15 per ounce, a record high at the time.

In 2023, gold prices continued to reach new highs amid steep inflation, attributed largely to demand for the metal in emerging markets, according to the World Gold Council. The industry group forecasted that escalating conflict in the Middle East would add to inflation fears, likely raising the price of gold in 2024.

Story editing by Rose Shilling. Copy editing by Tim Bruns.

This story originally appeared on SD Bullion and was produced and

distributed in partnership with Stacker Studio.