How inflation has affected vacation rentals—and how it could impact your next trip

Published 6:00 pm Monday, February 6, 2023

Daxiao Productions // Shutterstock

How inflation has affected vacation rentals—and how it could impact your next trip

In years past, booking a short-term rental for vacation was a fun, cost-effective way to experience a new destination. With filters for price points, privacy, and choice amenities, finding anything from a beachside apartment to a treehouse in the forest was a breeze for travel enthusiasts. While demand has not decreased for short-term rentals, the hospitality industry has changed, and travelers are taking note.

The early COVID-19 pandemic halted traveling worldwide for most, with many international borders closing in the first year of the global health crisis. As countries have reopened and traveling becomes more widespread again, the rising cost of travel and day-to-day life has pinched budgets across the world. In 2020, inflation was at 1.4%, but the U.S. Inflation Calculator reported a staggering jump to highs of 7% in 2021 and 2022.

With the aid of industry experts, news coverage, and government databases, including sources from the Bureau of Labor Statistics, AirDNA, and Forbes, Bounce explored the ways inflation has affected short-term vacation rentals in the United States. This analysis also looks at what travel could look like in 2023 and cited predictions on what inflation may look like for Americans in the next few months.

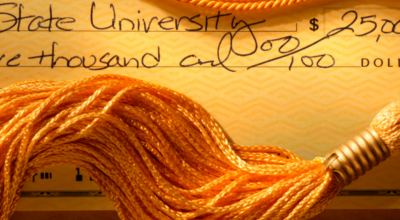

Rising inflation often means rent hikes from property owners as their expenses for maintaining their property become larger. Blackstone writers Joe Zidle and Nadeem Meghji suggest that, to counter inflation, investing in short-term rental properties and adjusting prices for market and inflation rates can benefit those looking for investment opportunities. Investing in short-term rentals “may be one of the best strategies for the foreseeable economic climate,” according to a December 2022 report from Forbes Business Council’s Sebastian Rivas.

Many travelers are changing their plans due to the economy; while 43% of adults in the U.S. planned to take overnight vacations between Thanksgiving and New Year’s in 2022, about 4 in 5 said they were modifying plans to adjust for rising travel fares.

Despite average daily rates for short-term rentals expected to rise by 1.7% in 2023, demand from travelers remains strong, with the first three quarters of 2022 showing an increase of 20.9% in nights stayed year over year. While demand growth is only expected to gain 5.5% in 2023, trends show that short-term rental demand is steady.

![]()

Carrie’s Camera // Shutterstock

Short-term rentals are pricier

With inflation on the rise, travelers planning their next adventure are noting the hefty new fees and prices on short-term rentals. Using data analytics on the short-term rental market to decipher rising costs is helpful for travelers or property owners looking to break down costs.

AirDNA is an analytics company providing data for the lucrative short-term rental industry, valued at $140 billion. In its 2023 outlook report, released in December 2022, it cited a 5.6% price increase in nightly stays, with the average daily rate increasing from $259 to $274. With a 2022 inflation increase of 7.1%, hosts are pocketing less than in prior years, collecting payments at a lower true rate. Despite these raised prices, demand for short-term rentals remained high in the first three quarters of 2022, breaking the highest-ever recorded number of nights stayed for renters.

Mark Winfrey // Shutterstock

Key factors behind more expensive rentals

A report in November 2022 by Pacaso found an approximate 235% sales increase from the year prior on investment properties and second homes from April to June. While data from AirDNA showed demand for short-term rentals has risen in the past year, economic pressures are pushing many homeowners to list their properties as vacation stays for extra income.

2022 also saw a housing slowdown, with housing prices increasing by 45% from December 2019 to June 2022. The average homebuyer in October 2022 paid 77% more for their loan per month than the previous year, according to Realtor.com. Economist Taylor Marr of Redfin told the Wall Street Journal that while the demand for second homes more than doubled during the pandemic, many are looking to rent out their homes as the housing market begins to cool and the economy becomes less lucrative.

While many hosts saw buying more property as a stable investment due to the profit margins seen in short-term rentals in years prior, many are seeing fewer bookings on their properties, and travelers are being charged higher fees for their stays.

Monkey Business Images // Shutterstock

Other travel costs are rising too

Travelers faced rising costs of travel in other areas in 2022. Airlines encountered a standstill in travel during the early pandemic, and recovery has been slow for the industry due to numerous factors. Russia’s war in Ukraine caused a colossal rise in fuel costs, and with travelers booking flights across the country again, airlines are struggling to meet demand with supply scarcity, labor shortage, aircraft delivery issues, and more.

2022 saw an overall 36% increase in airline tickets, with September through November seeing a record-breaking 42.9% increase in airfare, according to the BLS. Last year also saw airfare inflation at five times the national average, with higher costs possibly dissuading travelers from booking trips, affecting the demand for short-term rentals.

Renting a car can open up travel opportunities for those deterred by airline prices, although the car shortages that plagued Americans in 2020 remain an issue. In July 2021, costs for rental cars saw an all-time high, and in 2022, they saw high monthly prices far above any rental car cost pre-pandemic.

Apart from transportation, other luxuries of travel have risen in cost, such as dining in restaurants. The Consumer Price Index for food reported in November 2022 that food prices were 10.6% higher than in November 2021 and are expected to increase slowly in 2023 by 3.5 to 4.5%. Restaurants are facing unprecedented times with staff shortages, rising shipping costs, and the high price of ingredients. The average pretax profit for a restaurant with annual sales of $900,000 has dropped from 5% to 1%, according to the National Restaurant Association.

TZIDO SUN // Shutterstock

November data signals that inflation is cooling

The nation could be reaching a much-needed cooling-off period, with inflation rates subsiding slightly in November 2022, marking the fifth month of decline and the lowest inflation reading since December 2021. Food and energy costs are still high at a 10.6% and 13.1% increase, respectively, since November 2021 but are seeing a slower rise. Additionally, there was a 1.6% decrease in energy prices in the concurrent time period.

A 2023 prediction that could alter the inflation rate is an unwelcome one, with many economists predicting a recession as the federal government slows the economy. The National Bureau of Economic Research defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

pikselstock // Shutterstock

What could all this mean for vacations in 2023?

With economic concerns rising nationwide, what’s in store for the future of the vacation rental industry? 2023 is predicted to ease in inflation and lessen the wage gap, with a November 2022 Survey of Professional Forecasters predicting a slowdown of inflation to 2.9% in 2023 and a further decline of 2.3% in 2024.

Steady employment rates, a decrease in inflation, and an uptick in consumer interest in travel are forecast to create growth in the short-term rental market and provide financial recovery for travelers to urban areas. Demand for vacation rentals is exceeding expectations, with a prediction that demand will grow 5.5% in 2023 and on. 2022 trends collected by AirDNA showed demand for short-term rentals, or STRs, growing in spring and autumn, typically considered slower seasons for vacationers. These trends are predicted to continue in 2023 as travelers take advantage of lower rates during these slower “shoulder” months with less travel activity.

While a mild recession and declining employment are predicted for 2023 by Oxford Economics, AirDNA predicts the STR market will be one of the least affected industries. Demand is shifting from the urban market to lesser-known small cities and rural settings, as well as resorts and destination vacations. These markets’ expansion of available listings allows travelers to explore hidden gems not accessible in the short-term rental market before the pandemic.

Vacation rental prices are expected to rise and demand has doubled from 2019-2022 in rural areas and small cities, showing that travelers are taking advantage of growing occupancy rates. While AirDNA predicts slower growth in demand for STR in 2023, a decline will still see demand higher than pre-pandemic levels.

The Travel Foundation predicts an influx in travel spending for 2023, and with the U.S. dollar at its strongest than in years prior, international travel in lower-cost countries is an attractive option for travelers. Travelers are booking further in advance for 2023 than they did in 2019, and a Virtuoso survey found 7 in 10 respondents are prioritizing environmentally sustainable travel. Half of the participants noted they were already anticipating plans for summer 2023, according to an American Express Travel survey. In a plus for the U.S. economy, many are choosing to travel cross country rather than internationally; an Expedia survey found about 3 in 5 participants planned to travel within the U.S.

This story originally appeared on Bounce and was produced and

distributed in partnership with Stacker Studio.

More Stacker National